ASX claws back losses to end flat, CBA and gold hit record highs — as it happened

The anxiety over another Wall Street dive was brushed aside as the ASX clawed back steep early losses to end the day flat.

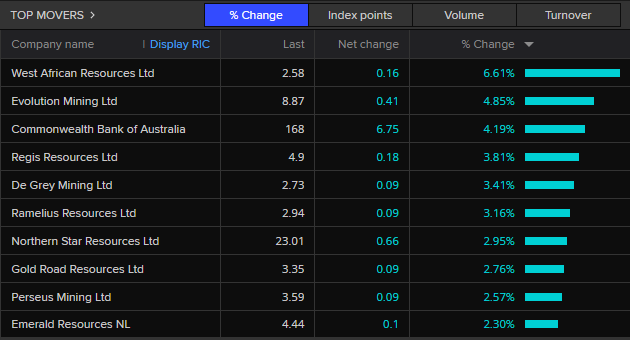

The highlights of the day was the world's most expensive bank, CBA, finding a second wind powering to a record close, while gold pushing the $3,500/ounce dragged the gold mining sector higher.

Look back on how the session unfolded, plus insights from our specialist business reporters, on our blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: flat at 7,817 points (live values below)

- Australian dollar: +0.3% to 64.34 US cents

- Asia: Nikkei -0.2%, Hang Seng +0.5%, Shanghai comp +0.5%

- Wall Street: Dow -2.4%, S&P 500 -2.5%, Nasdaq -2.5%

- Europe (Thursday): DAX -0.5%, FTSE flat, Eurostoxx -0.3%

- Spot gold: +2.1% to $US3,500/ounce

- Brent crude: +0.5% to US$66.60/barrel

- Iron ore (Thursday): +2.2% to $US99.60/tonne

- Bitcoin: +1.2% to $US88,361

Prices current around 4:20pm AEST

Live updates on the major ASX indices:

Goodbye

That's it for another day on the blog.

After some pre-opening anxiety, the ASX, and most stock exchanges in the region, waved away concerns with little or any damage inflicted by US investors fleeing for the exits (again) overnight.

Wall Street, at least for now, seems to overcome its latest conniptions and futures trading on the S&P 500, Dow and Nasdaq point to a positive opening later tonight.

CBA powered through the tumult, closing 4.2% higher at new record close of $168/share.

Gold pushing through $3,500/ounce was more predictable, hoovering up liquidity splashed around in the "Sell America" trade.

The blog will recharge its batteries overnight, but in the meantime, you can tune into The Business with Kirstin Aiken on ABC News at 8:45pm AEST or after the Late News on ABC-TV to get another finance fix.

Until next time ...

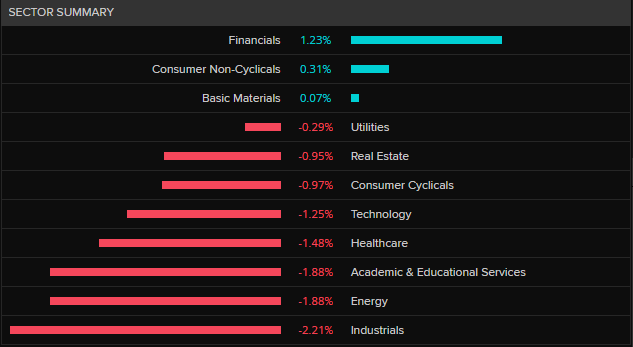

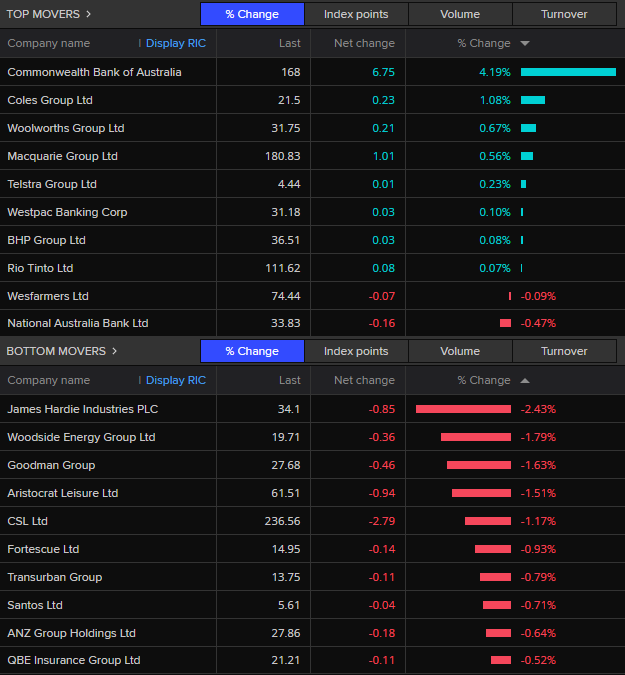

ASX 200 closes flat, CBA and gold hit new highs

Fears that Wall Street's 3% overnight dive would hit the ASX have been vanquished.

Having opened sharply lower, the ASX 200 clawed its way back to close down just 2 points from where it started the day.

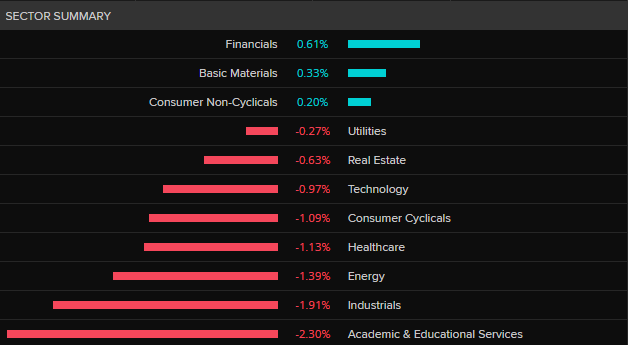

There was some damage across the sectors, particularly among the uranium miners and some industrials, but nothing as severe as witnessed in the US overnight.

The banks had mixed day with the exception of CBA.

The world's most expensive bank leapt 4.2%, seemingly on no new news, to a record close of $168/share.

Macquarie gained 0.6% after offloading an offshore asset management business for $2.8 billion.

The big miners were also mixed with BHP and Rio Tinto eking out small gains on slightly firmer iron ore prices, while the other major players suffered.

Tech stocks did not enjoy the best of days after the Nasdaq tumbled almost 3% overnight.

However, such was the heft of CBA that the big end of town represented by the ASX 20 index gained 0.5%.

Gold miners dominated the ASX 200 top movers as the price of gold pushed through $US3,500/ounce

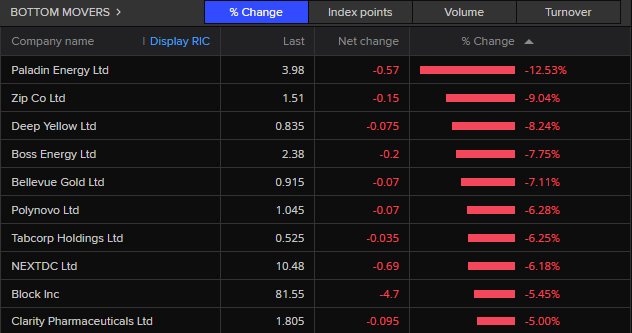

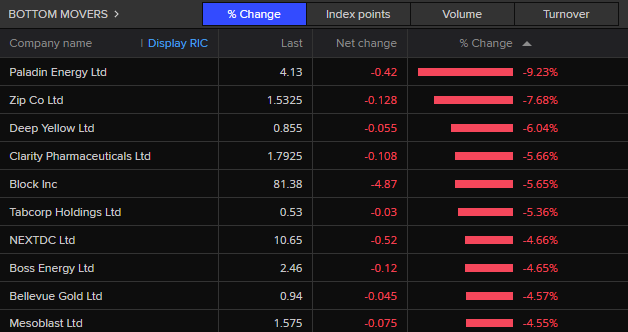

Uranium miners featured prominently among the ASX 200's biggest losers along with payment platforms Zip Co and Block.

CBA closes at a record high $168

The world's most expensive bank CBA just got a little more expensive after another blistering day's buying by investors.

CBA jumped 4.2% to hit $168/share, eclipsing the previous record of $166.72 set back in February.

Gold hits $US3,500/ounce

Bit of news flash here — Reuters screens have just flashed the alert that gold has punched through $US3,500/ounce.

That's it — you can go back to what you were doing.

Petrol falls 0.9 cents in a week

Hi team,

Just jumping in with the latest from the Australian Institute of Petroleum on what you're paying at the pump.

The national average price of a litre of unleaded petrol fell 0.9 cents to 178.8 cents in the week to Sunday.

Weekly data from the Australian Institute of Petroleum details the slide, which puts the average further below the 12-month average figure of 185 cents.

International market trends are lower, meaning we're likely to see that cost flow down over the coming weeks once fuel is bought in Singapore, shipped here, unloaded, put into trucks, transferred to petrol station tanks and then into the fuel tank of your car.

Amazingly, after all that, most service stations make their margin on the chocolate bars.

AustralianSuper confirms 10 accounts were looted in cyber theft

AustralianSuper has confirmed money was taken from 10 accounts in a recent cyber fraud that affected a number of super funds.

The figure quoted in a letter to fund members from chief executive Paul Schroder is higher than previous estimates.

Earlier this month, AustralianSuper temporarily locked about 600 members' accounts that were considered vulnerable to the fraud.

"Our systems repelled most of the attempted fraud on these accounts but unfortunately, money was stolen from 10 accounts," Mr Schoder said.

"All of those members have been reimbursed. We will continue to investigate this matter."

Mr Schoder was at pains to point out that AustralianSuper had not been "hacked".

"Criminals used stolen passwords and personal identity information from other sources to access accounts to commit fraud," he said.

"Unlike other recent cyber incidents reported in the media over the last few years, cyber criminals did not access our systems."

Morgan Stanley cuts ASX 200 target 8,000 points

The big broker Morgan Stanley has cut its year-end target for the ASX 200 to 8,000 points, which would represent a roughly 2% gain from current levels.

However, it is a 6% cut from the previous forecast of 8,500 points, a level Morgan Stanley says could now be reached mid-2026.

Morgan Stanley's respected equity strategy team, led by Chris Nichol, says Australia is emerging "from recent tariff volatility in a resilient position".

Most of the downward revision can be sheeted home to risks relating to lower global growth and falling commodity prices.

"[The] Defensive appeal for the Australian macro and equity market investment case, at least in relative terms, has been on display in the recent period of market volatility," Mr Nichol wrote in a note to clients.

"Minimal first order tariff impacts combined with still supportive fiscal settings and a degree of monetary policy flexibility to counter global growth risks can be seen as attractive."

The Morgan Stanley house view is for a 25bp rate cut next month, followed by cuts in July and August taking the cash rate down to 3.35% to the end of the year.

The Morgan Stanley modelling lifted its "bear case" scenario from an end of year 6,250 points to 6,750 points.

"There is always some further residual risk from commodity-linked earnings but this is somewhat compensated by an expectation that domestic-sourced earnings can benefit from an RBA finding neutral at a faster pace than previously thought and still supportive fiscal dynamics," Mr Nichol said.

Are you a property investor? Or would-be home buyer?

Are you a property investor or would-be home buyer with views around housing policy in the lead up to the May 3 election?

The major parties have revealed a slew of policies, some targeted at helping first-time buyers into the market, while others aim to encourage more supply.

The Coalition and Labor are staying away from negative gearing and the capital gains tax discount.

The Greens have called for the tax breaks to be phased out for investors with more than one investment property.

Business reporter Nassim Khadem is looking into the issues weighing on home buyers and investors as they prepare to head to the ballot box and would like to speak to people for a TV story.

Get in touch at khadem.nassim@abc.net.au.

Wall Street futures positive

Just a quick glance at the screen to see how Wall Street is looking ahead of opening later tonight and it seems the market has regained its composure with futures trading in the three key indices pointing to gains.

- S&P 500 futures: +0.4%

- Dow futures: +0.3%

- Nasdaq futures: +0.4%

There is of course an important caveat here; these figures don't include any impact from any yet to be published White House social media posts.

This morning's characterisation of US Federal Reserve chair Jerome Powell as "Mr Too Late" by President Trump seemed to trigger a $US750 billion sell off.

The patriotic Chinese investors buying the dip

An interesting piece from Reuters highlights how retail investors have joined efforts to keep China's stock market stable.

Amid the trade war between America and China, the news agency has spoken to small-time investors, some wading into the market for the first time, who are vowing to hold on to stocks in a show of patriotism, rather than seeking a windfall.

It comes as Chinese exchange-traded funds (ETFs) received record inflows of cash from state-backed buyers, with nearly $US24 billion ($37 billion) flowing in during the week starting April 7, according to Bloomberg.

Here's more from Reuters:

Cao Mingjie had never traded stocks before Donald Trump's "Liberation Day".

The home designer from China's southern Guangdong province changed his mind after April 2, when the US president announced "reciprocal tariffs", intensifying a trade war with his country.

Keen to show solidarity with Beijing, Cao decided he would invest 2,000 yuan ($426) in the local stock market every month.

"The goal isn't to make money. It's about contributing to my country," said Cao. He said he opened trading accounts after the higher tariffs hit Chinese stocks.

In this trade war, "every individual should stand by the country until the end".

Like Cao, many retail investors are joining the state-backed "national team" to defend the stock market — another battlefield in the broadening Sino-US conflict, traders and brokers say.

Buying has been focused on sectors set to benefit from China's national agenda, such as defence, consumer and semiconductors.

The patriotic fervour is unusual in small investors, notorious for their casino mentality, and a welcome change for authorities seeking to counter the panic caused by the trade war and stabilise capital markets.

Since the rout on April 4, China's share markets have received 45 billion yuan in net retail inflows, data from financial information provider Datayes shows.

That compares with six straight sessions of outflows totalling 91.8 billion yuan ahead of Trump's "Liberation Day".

Previously, private and state investors clashed during the 2015 market crash and in the aftermath of Beijing's crackdown of technology companies, undermining market rescue efforts.

But now, their interests appear aligned as Trump threatens eye-popping import tariffs that China has described as "bullying", even if some retail investors are merely opportunistic and riding on Beijing's swift and resolute intervention.

As China stocks plunged 7% on April 7, state-backed institutional investors publicly vowed to buy more shares, top Chinese brokerages pledged to steady prices, and a slew of listed companies unveiled share buyback plans.

Last week, Chinese Premier Li Qiang urged government officials to strengthen efforts to steady the stock market.

China's stock market, the Shangahi Composite, has bounced 8% from seven-month lows hit early April, and is down just 1.3% so far this month.

That compares with a slump of more than 8% for US stocks on the S&P 500.

"We think China's A-share market is of greater strategic importance," said Meng Lei, China equity strategist at UBS Securities.

Patriotic bets have "meaningfully improved investor sentiment", Meng said.

Can you pack some snacks?

How is the AUD holding up against the £ and Euro? Looks like I might not be eating much on my holiday next month ….

- Corinne

Hi Corinne — firstly, I hope you are excited for your upcoming trip!

I just had a quick squiz at the forecast and it looks like by next Monday and Tuesday, London will be enjoying a positively balmy 21 degrees, so I'm very jealous as I look out the window in damp and grey Sydney.

Now for the bad news — the Aussie dollar has not fared so well against the pound or euro lately.

Against the euro, it's down 9.9 per cent over the past 6 months.

At the moment, it's buying around 55.8 euro cents.

As for the pound, its down 6.8 per cent over the same period.

Currently, one Aussie dollar will get you around 48 British pence.

Maybe see if you can squeeze something non-perishable in your suitcase? Or not.

ASX shrugs off Wall Street dive

Fears that Wall Street's 3% overnight dive would hit the ASX appear to have subsided.

At 1:20pm AEST, the ASX 200 had clawed back to about where it started the day at 7,813 points.

There's been some damage across the sectors, particularly among the uranium miners and some industrials, but nothing as severe as witnessed in the US.

The banks have largely made gains with CBA (+1.7%) the standout, and Macquarie up 1.7% after offloading an offshore asset management business for $2.8 billion.

The big miners have also staged a comeback on slightly firmer iron ore prices.

Tech stocks have not enjoyed the best of days after the Nasdaq tumbled almost 3% overnight.

The best performing stocks on the ASX 200 are dominated by gold miners.

Uranium miners feature prominently among the biggest losers along with payment platforms Zip Co and Block.

'Return to office' demands may have peaked, survey finds

New research shows despite a political furore and media reports of a push by major employers for staff to return to the office, demands for a certain number of "in-person" days are falling.

A survey by the Australian HR Institute shows more than 80 per cent of respondents say hybrid working — a mix of in-person, remote and work from home (WFH) — will increase or stay the same in the coming two years.

According to the data in the report, 'Hybrid and Flexible Working Practices in Australian Workplaces in 2025':

- 44 per cent of workplaces require in-office attendance at between three and five days a week — down from 48 per cent of employers in 2023

- The most common model for in-office attendance is about three days a week (30 per cent of respondents)

- The next most common model for in-office attendance is "no minimum requirement", but with encouragement to attend

The institute surveyed 994 HR professionals from Australian companies in January and February this year, with about half of the respondents working in the private sector.

The remainder were split between public and not-for-profit.

Read more on how WFH is shaping hiring and workplace policies from business reporter Daniel Ziffer:

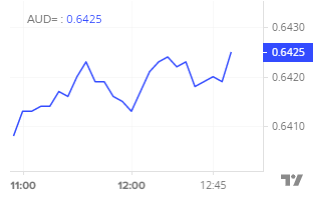

Aussie dollar at 64.2 US cents as US dollar falls

The Australian dollar is up against a falling greenback.

Here's how it's fared today so far:

That puts the local currency back at levels against the US dollar last seen in mid-February.

Just two weeks ago it fell below 60 US cents as the US tariff announcements roiled financial markets.

Now, the US dollar index is down sharply:

The US dollar index measures the performance of the American currency against a basket of other currencies, including the euro, the yen and the pound.

Market snapshot

- ASX 200: flat at 7,820 points (live values below)

- Australian dollar: +0.2% to 64.24 US cents

- Asia: Nikkei -0.1%, Hang Seng -0.5%, Shanghai comp +0.2%

- Wall Street: Dow -2.4%, S&P 500 -2.5%, Nasdaq -2.5%

- Europe (Thursday): DAX -0.5%, FTSE flat, Eurostoxx -0.3%

- Spot gold: +1.4% to $US3,472/ounce

- Brent crude: +0.5% to US$66.60/barrel

- Iron ore (Thursday): +2.2% to $US99.60/tonne

- Bitcoin: +1.1% to $US88,233

Prices current around 1:00pm AEST

Live updates on the major ASX indices:

Is Macquarie's US and European public markets exit a 'stain' on management's track record?

The big Swiss investment bank UBS has put out an interesting note on its smaller Australian competitor's retreat from its public markets business in the US and Europe.

As we posted earlier, the Aussie investment banking champion, Macquarie, announced it was selling its Philadelphia-based North American and European public investments business to the Japanese giant Nomura for $2.8 billion.

UBS says the retreat, while making strategic sense, is still something of a failed ambition.

"Macquarie has made a big inorganic push into the North American market the past 15 years, acquiring Delaware for $450 million in 2010, and most recently Waddell & Reed in 2021 for $1.7 billion," UBS analyst John Storey wrote in a note to clients.

"But is this a stain on management's track record around capital deployment?

"Today's announcement highlights the challenges which active managers are facing as the industry continues to consolidate.

"Strategically, we think this transaction makes sense, given the business has operationally struggled but is disappointing given the time and resources committed to building out this business."

The public investments business contributes about 20% of Macquarie Asset Management's (MAM)net profit.

"This sale will have an impact of about A$200 million on MAM's NPC (net profit contribution), which translates to about A$100 million in net profit after taxes and profit sharing, making up roughly 2-2.5% of the group's total earnings," Mr Storey said.

Asian markets flat

Asian markets have reacted to Wall Street's overnight conniption with a bit of a yawn.

Most of the key markets are either up a bit, or down a bit.

At 12:20pm (AEST):

- Japan's Nikkei: -0.1%

- Hong Kong's Hang Seng: -0.7%

- Shanghai's composite: +0.1%

- Korea's Kospi: +0.1%

ASX mounts fightback from early fall

The ASX appears to be shrugging off Wall Street's overnight tantrum and at midday (AEST) had clawed back most of its early losses.

At 7,813 points, the ASX 200 is now down less than 0.1% from its opening.

Much of the fightback can be put down to demand for gold and financial stocks.

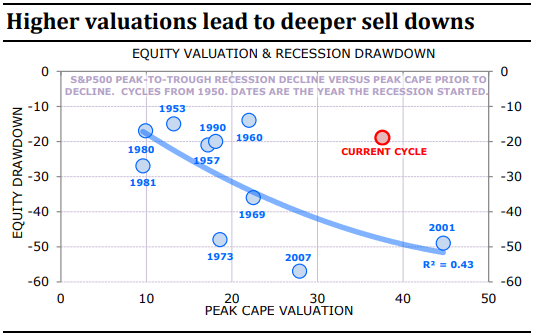

Markets haven't priced in a recession

So how far have global equity markets got left to fall?

Still a long way, particularly if there's a recession, according to one of the most astute market strategists, Gerard Minack.

"If there is a recession, the high starting point valuation of equities in this cycle could lead to a 40%-plus peak to-trough decline in the S&P500," Mr Minack calculated.

Mr Minack has very good track record on such things.

Back in 2006, while working as a global strategist for Morgan Stanley, he predicted that the S&P 500 and ASX would halve in value by 2008.

As he points out, that call was a bit conservative — the peak-to-trough fall between October 2007 and March 2009 was 55% and he missed the start of the unravelling by a couple of months.

Still, not bad and would have saved his clients billions (assuming they followed the rather brave call at the time).

Now a private advisor to a raft of financial institutions and private equity firms, Mr Minack says the market has yet to price in the risk of a recession in the US.

"While the market is recognising the risk, I don't think recession is in the price," He wrote in his influential Downunder Daily note overnight.

"In any case, the S&P500 has never made its cycle low before the recession has started.

"Typically, the S&P500 bottoms 7 months (average) or 4 months (median) after the start of an NBER (National Bureau of Economic Research)-defined recession."

The S&P 500 is down around 15% from its February high, but Mr Minack says on any standard metric it is still expensive, and expensive relative to other equity markets.

"This matters because the depth of recession-driven bear markets is a function of both the economic severity of the recession and the valuation starting point of the equity market.

"The equity declines in the GFC and the TMT (dot-com bubble in 2000) cycles were similar.

"But the GFC decline was driven by Depression-like economic havoc, while the TMT sell-off was largely due to the extravagant valuation starting point of equities."