Rate cut expectations remain high, ASX flat despite surprising jobs surge — as it happened

Markets are still almost certain of an interest rate cut next Tuesday, and three by the end of the year, despite a shock 89,000-strong increase in employment.

The ASX closed broadly flat as financial sector gains more than offset mining and energy losses.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market Snapshot

- ASX 200: 0.22% at 8,298 points (live values below)

- Australian dollar: flat at 64.25 US cents

- Asia: Nikkei (-0.99%), HSI (-0.9%), Shanghai (-0.71%)

- Wall Street: Dow Jones (-0.21%), S&P 500 (+0.1%), Nasdaq (+0.72%)

- Europe: FTSE (-0.21%), DAX (-0.47%), Stoxx 600 (-0.24%)

- Spot gold: -1.36% to $US3,135/ounce

- Brent crude: -2.33% to $US64.55/barrel

- Iron ore: -0.5% to $US101.25/tonne

- Bitcoin: -0.93% to $US102,600.98

Prices current around 4:17pm AEST

Live updates from major ASX indices:

Market finishes ahead, buoyed by jobs data and financial stocks

The ASX finished 0.22% higher at 8297.5 points today, with rosy jobs data and strong performing financial stocks offsetting a slide in the mining industry.

Stocks in the heavyweight financial sector — including the big four banks — posted gains of 1.1%, with the much smaller technology sector also gaining 1.05%.

Meanwhile, Real Estate stocks slipped 1.3%, followed then by Energy at 1.03%, while the large mining sector was down around 1%.

GrainCorp Ltd, an agribusiness and processing company, had price growth of 8.81% to finish the day at $7.78 a share, after the market welcomed its half-yearly result.

IAG, the largest general insurance company in the country, finished 5.7% higher at $8.90 a share. The strong performance was driven by news it will be snapping up RACWA's entire insurance operations in a deal worth $1.3 billion.

The largest percentage share price tumble was experienced by NRW Holdings. Shares were trading 8.28% lower by close of market, after the company revealed a proposed Whyalla bill in the SA Paliament could result in a $113.3 impairment.

Gold miners had a particularly bad day with sector giant Newmont down 3.98%.

The Australian dollar closed at 64.26 US cents.

That's a wrap for today - thanks for sticking with us. Emilia Terzon will be back tomorrow.

Volvo to build electric trucks in Australia

Vehicle manufacturer Volvo plans on building electric heavy-duty trucks at its Wacol facility in Brisbane from next year, claiming a third of the truck's production will be based in Australia.

Volvo's announcement comes as it hands the keys of 10 electric heavy-duty trucks to logistics company Linfox, claiming it'll be the next 10 wearing an "Australian Made" label when they are delivered in 2026.

"Today signifies not just the delivery of electric trucks, but the dawn of a new era for Australian manufacturing," Volvo chief executive Martin Lundstedt said.

"This landmark order from Linfox, coupled with our commitment to build a third of these electric vehicles right here in Australia, demonstrates our confidence in the local industry's potential to lead the way in sustainable heavy transport, perfectly suited to Australia’s demanding distances and conditions."

Linfox has been trialling four Volvo electric heavy-duty trucks as early as 2021.

Australian market up 0.2% after strong jobs data result

The ASX has made a modest 0.2% gain as the close of market nears.

It follows news from the ABS that 89,000 jobs were added in April — much stronger jobs growth than had been forecast — and a steady unemployment rate of 4.1%.

GrainCorp's stock price continues to rally with the price now up 8.25%.

And although NRH Holding's share price has fallen 8.28 per cent today, the momentum is going the other way — it's nearly recovered 2% since around midday.

Will 20 per cent HECS discount apply before debts are indexed on June 1?

Any chance the new labor government is going to be able to apply the 20% discount to HELP debt balances before the CPI is applied on the 1st of June?

- Ryan

Good question Ryan.

Parliament won't sit again until July, which isn't surprising as there are still a couple of electorates where the result is yet to be decided and the senators just elected don't take office until July 1.

According to both the ATO and the Department of Education, the policy as announced was for the 20% discount to apply before indexation occurs on June 1.

"The 20% reduction will be calculated based on what a person's HELP debt amount was as at 1 June 2025, before indexation was applied," notes the department's website.

"This means that indexation would apply only to the remaining loan debt balance e.g. after the HELP debt has been reduced by 20%."

However, the whole policy is subject to the passage of legislation, so I guess it will depend on whether the legislation retrospectively applies the discount from June 1, 2025 prior to indexation being applied.

It is entirely possible to do this — it is what the government did with its changes to HECS indexation, which were retrospectively applied with debts reduced accordingly by the ATO.

Watch this space.

Correction on Xero's profit number

You reported that Xero made " a full year profit of $354 million ($NZ227.8 million)." How does $354 million translate into $NZ227.8 million?

- Alan

Hi Alan, good spot.

I had a chat with Alicia who went back to the profit report and confirmed that the NZD figure of $NZ227.8 million is correct.

We are not sure exactly how that $354 million number popped in there, but it has been removed and replaced with the correct conversion.

Apologies and thanks for alerting us.

The key barrier holding up Donald Trump's economic agenda

Our business correspondent David Taylor has penned an analysis on what's amounting to be the global financial system's proverbial 'warning light': the bond market.

He explains how US President Donald Trump's tariffs has set off a series of events that resulted in "a highly unusual environment where both shares and bonds were sold off".

Give it a read to understand the global forces at play and what it could mean for the money market.

Graincorp, IAG lead in otherwise flat trading on the ASX 200

The ASX is pretty flat at the moment, but there are some industries climbing and others that aren't doing as well.

The strongest performers so far are Utilities (0.63%) and Consumer Cyclicals (0.60%), while the biggest drops are being felt in Basic Materials (-1.24%) and Academic and Educational Services (-0.80%).

Agribusiness and processing company Graincorp Ltd is leading with its shares rallying by 7.41% after the market welcomed its half-yearly result.

General insurance company IAG followed with its share price up 4.87%, off the back of news it would be acquiring the insurance underwriting business of RACWA.

Meanwhile, NRW Holdings Ltd shares plunged 10.17%, after warning it could incur a $113.3m impairment if SA's parliament passes a proposed Whyalla Bill.

Treasury Wine Estates dropped 5.81% on the news Sam Fischer has been tapped to run the company as CEO, succeeding the 14-year term of Tim Ford.

Prices current around 1:00pm AEST.

Xero shares rally on 30% profit increase

Cloud accounting and payroll software company Xero has delighted the market as it continues to grow customers & revenue, and make a full year profit of $NZ227.8 million ($208.7 million).

Revenue jumped 23 per cent and global subscribers rose 6 per cent to 4.4 million.

The NZ founded business is looking to the "untapped" opportunity globally. CEO Sukhinder Singh Cassidy indicated as much when announcing the results to the market.

“We remain excited about the large, untapped opportunity to help SMBs and accountants and bookkeepers globally to digitise, and we continue to focus on making life better for people in small business, their advisers, and communities around the world," she said.

The US is a key opportunity for the San Franciso based CEO. The company still derives the bulk of its earnings from Australia and New Zealand making $1.17 billion in revenue in these key markets in the full year period, while pulling in just $139 million in revenue from the US.

Xero won't pay shareholders a dividend.

Investors have welcomed the result, with the stock trading up 4.0 per cent at $180.81 as of 1pm AEST.

I'm particularly interested in this result as Sukhinder Singh Cassidy is on The Business with me this evening, where I hope she can offer some insight into the US market. Tune in at 8:45pm on the ABC News Channel or anytime on iView.

Economist warns borrowers should only expect two more rate cuts

While most traders and economists remain convinced that the Reserve Bank will cut interest rates by a quarter of a percentage point at next week's meeting, many are now warning borrowers not to expect too many more cuts after that.

This from Abhijit Surya at Capital Economics:

"With the labour market going from strength to strength, we’re more convinced than ever that the RBA will be reluctant to cut rates aggressively. Accordingly, we’re sticking to our forecast for a terminal policy rate of 3.60%, which is higher than what most others are predicting," he writes.

"To be sure, there were signs of a slight adjustment in labour demand under the hood.

"For instance, hours worked per worker fell by 0.6% in April, their second consecutive monthly decline. As a result, they are nearly 2% lower than they were a year ago. Similarly, the underemployment rate edged up from 5.9% in March to 6.0% in April, while the underutilisation rate rose from 9.9% to 10.1% over this period.

"However, it bears mentioning that hours worked per worker have been in a structural long-term decline. And despite the upticks in rates of labour underutilisation, those measures low by historical standards."

The cash rate is currently 4.1%, having been cut in February from a peak of 4.35%. So a 'terminal' rate of 3.6% would mean only one more cut after next week, assuming Tuesday's cut happens as expected.

Market snapshot

- ASX 200: flat at 8,282 points (live values below)

- Australian dollar: +0.2% to 64.36 US cents

- Asia: Nikkei (-1.2%), HSI (-0.1%), Shanghai (-0.4%)

- Wall Street: Dow Jones (-0.2%), S&P 500 (+0.1%), Nasdaq (+0.7%)

- Europe: FTSE (-0.2%), DAX (-0.5%), Stoxx 600 (-0.2%)

- Spot gold: -0.5% to $US3,162/ounce

- Brent crude: -1.8% to $US64.90/barrel

- Iron ore: -0.5% to $US101.25/tonne

- Bitcoin: +0.6% to $US102,998

Prices current around 12:31pm AEST

Live updates from major ASX indices:

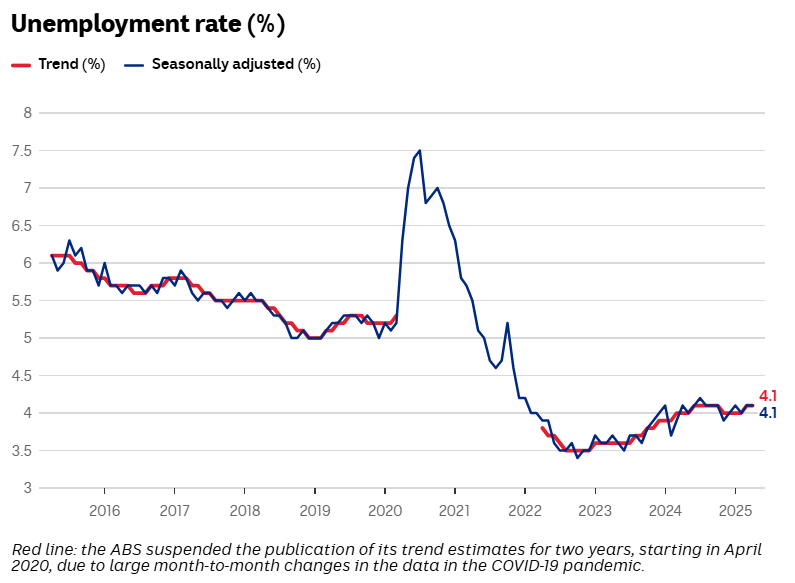

How the unemployment rate has been tracking

The unemployment rate has held steady at 4.1 per cent, but how did we get here?

Here's a chart of the ABS data over the last decade:

Business reporter Gareth Hutchens has more details on this morning's release here:

Fewer rate cuts expected this year as jobs market remains strong

Two key events this week have lowered expectations around how many times the Reserve Bank will cut interest rates in Australia.

One was Monday's surprise temporary tariff cuts between the US and China.

The other was today's much stronger-than-expected job creation in the Australian economy.

"Following the robust AU jobs report and US-China tariff cuts earlier this week, there are now only ~ 73bp [basis points] of RBA rate cuts priced between now and year-end (3 X 25bp rate cuts), significantly less than the 100bp priced on Monday morning," notes IG analyst Tony Sycamore.

"Today's jobs report has provided yet another reminder of the resilience of the Australian labour market, which was a factor in the RBA recently revising lower its unemployment forecasts to 4.2% from 4.5% for the end of 2025.

"Nonetheless, with trimmed mean inflation for Q1 2025 at 2.9% YoY — back into the RBA's 2-3% target for the first time since Q4 2021 and in line with RBA forecasts —coupled with downside risks to global growth due to still elevated tariffs, we anticipate the RBA will lower rates by 25 basis points to 3.85% at its meeting next week."

The RBA will give us its latest forecasts and current thinking on the economic outlook in its Statement on Monetary Policy, which is released at 2:30pm AEST, alongside its interest rate decision.

Traders slightly ease bets on a rate cut after stronger-than-expected jobs numbers

I've been watching our Bloomberg terminal closely before and after the jobs numbers came out to see what effect they had on market pricing for an interest rate cut next week.

Before 11:30am AEST, the interest rate swaps market was pricing in a 97% chance of rates being cut next Tuesday, most likely by a quarter of a percentage point.

That has eased to a 92% chance of a May rate cut.

It's probably safe to say almost all bets on a half-a-percentage-point rate cut are now off the table.

The betting on rate cuts further out has also softened slightly, with the market not quite as certain there will be three by the end of this year.

And bets on a fourth rate cut have been dramatically pared back, hinting that most traders now expect the cash rate to bottom around 3.35%.

Strong job creation won't hold back RBA rate cuts, says Indeed economist

The first economist note I've received on today's Labour Force numbers from the ABS comes from Callam 'Quick Draw' Pickering at jobs website Indeed.

Here's his key takeaways.

"Forward-looking measures of labour demand, such as Indeed job postings, continue to suggest that labour demand remains quite strong, supporting employment growth. This suggests that a near-term spike in the unemployment rate is unlikely, although given the amount of economic uncertainty that could obviously change quickly," he writes.

"Geopolitical and economic uncertainty makes it more difficult for Australian businesses to plan ahead. That includes hiring. And this uncertainty represents the greatest risk to Australia's job market over the remainder of the year."

Pickering used to work for the RBA as an economist many years ago, and these are his thoughts on how it might interpret this jobs data in the context of its interest rates decisions.

"The data will take a backseat to uncertainty when the RBA meets next week. Geopolitical and economic uncertainty has created an environment where the RBA will need to cut rates steadily over the next few months," he argues.

"The global economic outlook is suddenly much weaker, the US administration is unpredictable and unreliable, and while the direct impact of tariffs on Australia may be low, the indirect impact from weaker growth among our major trading partners may be quite large.

"The RBA will look to support the economy via looser monetary policy and they should cut rates next week and then again when they meet in early July."

We'll have very extensive coverage of the RBA's next meeting, with its rates decision out at 2:30pm AEST next Tuesday May 20.

I'll be at its quarterly Statement on Monetary Policy lock-up beforehand, so should get a decent handle about what our central bank is focused on in its economic outlook.

Women lead jobs growth, as employment-to-population ratio nears record levels

Some more analysis from the ABS on its latest jobs data:

The rise in employment was larger for females, up 65,000 (0.9 per cent), while male employment was up 24,000 (0.3 per cent). Female employment growth was mainly in full-time workers, which rose 42,000 (1.1 per cent) in April. Female part-time workers rose by 23,000 (0.8 per cent).

Employment has grown by 390,000 people, or 2.7 per cent, over the year. This annual growth rate is higher than the population growth rate for people aged 15 years and over, which was 2.1 per cent over the same period.

The strong growth in employment led to a rise in the employment-to-population ratio of 0.3 percentage points to 64.4 per cent in April, just below the record high of 64.5 per cent seen in January.

You can read the full press release here, and see the full ABS jobs data via the weblink below.

Unemployment steady at 4.1 per cent despite 89,000 extra people in jobs

Figures from the Australian Bureau of Statistics for April show 89,000 more Australians were in work than the month before.

Economists had generally only expected around a 20,000-strong increase in employment.

However, the unemployment rate remained steady at 4.1%. Why?

It's because the participation rates — the proportion of people in work or actively looking for it — jumped back by 3 percentage points to 67.1%.

In fact, there was a slight increase (6,000) in the estimated number of unemployed Australians last month, because the labour force grew by 95,000 but employment "only" increased by 89,000.

AUSTRAC drives through Mercedes Benz Financial Services

Our financial crimes agency AUSTRAC has ordered the appointment of an external auditor to Mercedes Benz Financial Services Australia after raising concerns about the financier’s compliance with the AML/CTF Act.

What's that? It's the responsibility to meet anti money laundering / counter terrorism financing laws.

In a release it's listed the problems, including:

- assuming most customers were low risk

- a lack of systems to identify and escalate suspicious matters

- inadequate transaction monitoring

AUSTRAC CEO Brendan Thomas said the non-bank lending sector, such as mortgage providers, personal loans, equipment and motor vehicle financing and leasing, have a responsibility to ensure they have the resources and processes in place to comply with their AML/CTF obligations.

“This industry is vulnerable to money launderers and organised criminals. We need to get better at shutting down avenues for criminals to profit from crime.

“The outcomes of this audit will help Mercedes Benz better meet their compliance obligations and will inform us if any further regulatory action is required."

There's been a regulatory campaign looking at the "non-bank" lending and financing sector, and AUSTRAC has concerns in relation to "gaps" that are leaving non-bank lenders and financiers open to money laundering risks.

“Our concerns extend beyond just one business in this sector and we have written to the entire sector detailing non-reporting and under-reporting as well as raising concerns with the sector’s ability to identify and manage high-risk customers and effectively monitor customer transactions.

“Almost 90 per cent of non-bank lenders and financiers did not report a single suspicious matter to AUSTRAC in 2024 and last year, just two businesses reported around half of all suspicious matters for the entire sector.

“Strikingly, 89 per cent of businesses said they had no high risk customers at all.

“This needs to change and it needs to change quickly or more business will find themselves in Mercedes Benz’s position. We expect businesses to improve their identification of high risk customers and to increase their reporting. We will be watching this very closely.”

It might seem obvious but they're making it clear.

“No business is devoid of risk."

Xero posts double digit growth in FY25 revenue

Accounting software firm Xero has released its financial results for FY25, achieving double digit growth in many key metrics compared to the previous year.

The company posted revenue of $2.1 billion, up 22.7 per cent compared to FY24.

While its EBITDA of $652.8m is an increase of 21.7 per cent, and its NPAT of $227.8m an increase of 30.4 per cent.

Its total subscriber base increased to 4.41m worldwide, nudging upwards by 0.9 per cent when compared to FY24.

E&P analyst Paul Mason said the company's results "are very much in line with consensus at the revenue level, and a slight miss at the EBITDA and lower item levels, but not extreme".

He added: "Our guess is they are getting ready to spend significantly more in the US market on sales & marketing now that the product has market fit."

Xero chief executive Sukhinder Singh Cassidy will be a guest on The Business tonight – tune in!

1 in 5 cars sold in 2024 was an EV

The International Energy Agency's annual review of the electric vehicle market shows 17 million EVs were sold around the world in 2024, representing about 1 in every 5 vehicles sold.

China was the engine of this growth, with 11 million EVs sold, or 40 per cent of all sales.

The most interesting parts of the report for me were the huge growth in sales recorded in South American and South-East Asian markets, which the IEA said was driven by increasing availability of affordable Chinese-made cars.

Compare that to the markets that have placed tariffs on Chinese manufacturers - EV sales growth was sluggish in the EU and USA.

And in those markets EVs are less affordable, like in Germany, an EV was 20 per cent more expensive than an internal combustion engine alternative, while US EV prices were 30 per cent higher.

More details about the IEA's report are here: